What the Heck Is Credit Card Stacking?

If you’ve ever heard people talk about “stacking” their rewards and thought, what the heck does that mean?—you’re in the right place. Stacking is simply the art of layering different perks, offers, and programs on the same purchase so you squeeze out the most value possible.

Think of it like using a coupon, a store sale, and a cash-back app all at once. Only here, it’s with credit cards, shopping portals, and brand partnerships.

What Is Credit Card Stacking?

At its core, stacking means combining multiple rewards opportunities into one purchase. Instead of just earning the standard points from your credit card, you can add extra bonuses from shopping portals, card-linked offers, and special partnerships.

It’s the same purchase—but you’re walking away with a lot more back in your pocket.

The Main Ways to Stack Rewards

Here are the three big stacking tools most people use:

1. Shopping Portals

Banks, airlines, and cashback platforms run shopping portals where you can click through before buying something online.

- Example: Click through Rakuten or Chase’s shopping portal and you’ll earn bonus cashback or miles on top of your regular card rewards.

2. Card-Linked Offers

These are deals you activate on your credit card before shopping.

- Example: Amex Offers or Chase Offers might give you “10% back at Starbucks.” When you use your card there, you’ll get the bonus plus your usual rewards.

3. Brand Partnerships

Some companies partner up to sweeten the deal.

Example: Booking an Airbnb through Delta earns you SkyMiles, or paying with a Starbucks-linked card can double up your rewards.

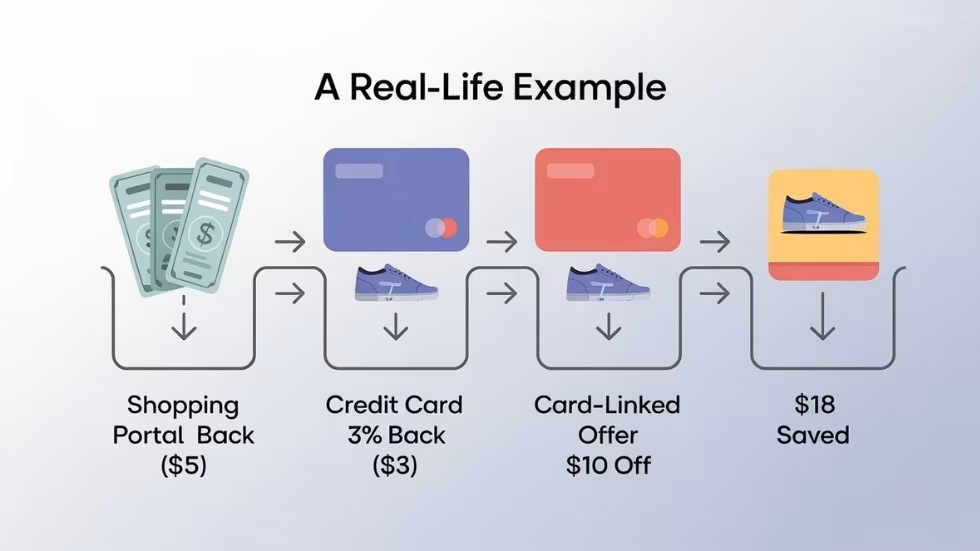

A Real-Life Example

Let’s say you buy $100 sneakers online:

- You click through a shopping portal for 5% back ($5).

- You pay with a credit card that earns 3% back ($3).

- You activate a card-linked offer for $10 off.

That’s $18 back on a $100 purchase—nearly 20% just for stacking smartly.

Why People Love Stacking

- It’s free money. These programs don’t cost anything to use.

- It adds up fast. A few dollars here and there can easily become hundreds a year.

- It makes big rewards possible. Many frequent flyers and travel hackers rely on stacking to unlock free trips and upgrades.

The Short Answer

Credit card stacking is when you layer rewards programs—like shopping portals, card-linked offers, and brand partnerships—on the same purchase to maximize cashback, points, or miles.

Bottom Line

If you’re just swiping your card and calling it a day, you’re leaving rewards behind. With stacking, the same purchases you already make can put more cashback in your wallet, rack up points faster, and even get you closer to free travel.

At Kiwii, our mission is to make stacking simple—so you don’t miss out on what’s rightfully yours.